Tax-free Employee Share Plan in Hungary – A Strategic Incentive for Businesses

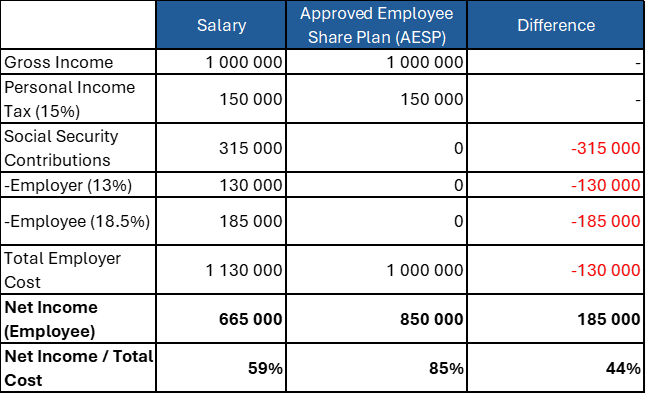

The Approved Employee Share Plan (AESP), as defined under Section 77/C of the Hungarian Personal Income Tax Act, is a securities-based incentive program designed to provide companies with a flexible and tax-efficient way to motivate employees and executives. Under this scheme, businesses can grant shares or share-related rights (such as purchase or subscription rights) to employees and executive officers under significantly more favorable tax conditions compared to traditional salary payments.

However, a crucial aspect of this Employee Share program is that participation cannot be linked to employee performance, meaning it cannot serve as a replacement for traditional bonuses. Additionally, companies can grant shares issued by themselves or affiliated entities tax-free, up to a market value of HUF 1 million per employee per year. Supervisory board members, however, are not eligible to participate in this program.

Table of Contents

ToggleTaxation Considerations

Tax obligations do not arise at the time of depositing the employee shares or acquiring purchase, subscription, or similar rights. Instead, tax liability is triggered only when the shares are sold (provided, that the mandatory holding period ends, i.e., after the second calendar year following acquisition). In this case, capital gains taxation applies, or, in the case of a publicly traded company, the rules of controlled capital market transactions.

If an employee sells or withdraws the employee shares from custody before the mandatory holding period expires, the income will, with few exceptions, be subject to taxation as salary. In such cases, the taxable income is determined based on the difference between the fair market value at the time of realization and the acquisition cost, including any incidental costs. Furthermore, any income exceeding HUF 1 million within a single tax year will also be taxed as salary.

Key Requirements for Implementation

When designing and implementing such an Employee Share Plan (AESP), companies must ensure compliance with the following conditions:

- The shares or related rights must be issued by the company itself or an affiliated entity.

- Only employees and executive officers of the company may acquire shares under the program.

- Shares can only be sold after the mandatory holding period, which lasts until the end of the second calendar year following the year of acquisition.

- The program must be fully documented and disclosed in writing to all eligible employees and executives.

- A maximum of 25% of participants may be executive officers.

- Executive officers may collectively acquire no more than 50% of the total share value granted under the program.

- The company’s chief financial officer, supervisory board members, and their close relatives are ineligible to participate.

- Eligibility for participation cannot be tied to individual employee performance and must remain independent of any direct compensation structure.

International Tax Considerations for Stock Options

The taxation of employee stock options can raise international tax implications. One common issue is determining the jurisdiction in which the income is taxable if an employee exercises an option based on employment in a previous period in a different country. Additionally, it may be necessary to establish where the income should be taxed if an employee has worked in multiple countries while earning the right to the option.

Addressing such cases requires an analysis of domestic tax regulations, applicable tax treaties, and OECD guidelines on the taxation of income and capital. Although tax treaties do not dictate how income is classified under national law, Hungarian tax rules independently determine whether and under what circumstances income from stock options is taxable. However, classification under international tax treaties may impose limitations on Hungary’s ability to tax such income.

Generally, income derived from employee stock options falls under the “income from employment” category in tax treaties, as stock option grants are considered a form of compensation, similar to salary, wages, or fringe benefits.

Conclusion

The AESP offers a valuable tax-efficient opportunity for companies to reward employees. However, proper structuring and compliance with legal requirements are critical to ensuring its benefits. As with any tax-advantaged scheme, strict adherence to regulatory deadlines and tax authority requirements is essential for maximizing the advantages of this program.

Categories

Tags

Download Tax Highlights, Hungary, 2025

Send download link to: